Delving into the Labyrinth of Corporate Acquisitions and Mergers: A Comprehensive Guide to Success

In the dynamic business landscape, corporate acquisitions and mergers have emerged as powerful tools to drive growth, reshape industries, and unlock value for shareholders. The United States, renowned as a global epicenter for business and finance, serves as a fertile ground for these transformative transactions. This comprehensive article delves into the complexities of corporate acquisitions and mergers in the United States, providing a roadmap for business leaders, investors, and professionals seeking to maximize the potential of these strategic maneuvers.

Navigating the Landscape of Corporate Acquisitions

Corporate acquisitions involve the Free Download of one company by another, resulting in the acquired company becoming a subsidiary of the acquiring company. Acquirers embark on this path for various reasons, including expanding market share, gaining access to new technologies or markets, or eliminating competition. Understanding the different types of acquisitions is crucial for effective execution:

4.8 out of 5

| Language | : | English |

| File size | : | 1060 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 259 pages |

- Friendly Acquisitions: Occur when the target company's management and board of directors welcome the acquisition proposal and cooperate throughout the process.

- Hostile Acquisitions: Arise when the target company resists the acquisition attempt, and the acquirer must pursue legal or other means to secure control.

- Strategic Acquisitions: Aim to enhance the acquirer's long-term competitive advantage by acquiring complementary businesses or technologies.

- Financial Acquisitions: Primarily driven by financial considerations, such as acquiring undervalued companies or gaining access to tax benefits.

The Art of Merger Negotiations

Mergers, unlike acquisitions, involve the combination of two or more companies into a new entity. This complex process requires careful planning and execution to ensure a seamless transition and maximize value creation. Key considerations during merger negotiations include:

- Valuation: Establishing a fair and reasonable exchange ratio for the merging companies' shares.

- Due Diligence: Thoroughly investigating the target company's financial health, operations, and legal compliance.

- Deal Structure: Determining the appropriate legal and financial structure for the merger, including the type of entity and tax implications.

- Integration Planning: Outlining the steps to merge the operations, cultures, and systems of the merging companies.

Post-Merger Integration: Unlocking the Synergy

Once a merger is complete, successful integration becomes paramount. This critical phase involves harmonizing the operations, processes, and cultures of the merging companies. Key elements of effective post-merger integration include:

- Communication: Establishing clear and consistent communication channels to keep employees, customers, and stakeholders informed.

- Cultural Alignment: Fostering a shared culture and values that promote collaboration and innovation.

- Operational Synergies: Identifying and realizing cost savings, revenue enhancements, and other operational improvements.

- Performance Monitoring: Regularly tracking key performance indicators to assess the progress and identify areas for improvement.

Regulatory Considerations in the United States

The United States has a robust regulatory framework governing corporate acquisitions and mergers. Understanding these regulations is essential to ensure compliance and avoid potential legal or financial penalties. Key regulatory bodies involved in merger reviews include:

- Federal Trade Commission (FTC): Enforces antitrust laws to prevent anti-competitive practices.

- Department of Justice (DOJ): Reviews mergers that have the potential to substantially lessen competition.

- Securities and Exchange Commission (SEC): Regulates public company mergers and ensures fair disclosure of material information.

Case Studies: Lessons from Notable Acquisitions and Mergers

Examining notable acquisitions and mergers in the United States provides valuable insights into the strategies and challenges involved in these complex transactions. Some renowned case studies include:

- AT&T's Acquisition of Time Warner: A transformative merger that created a media and telecommunications giant.

- Microsoft's Acquisition of Activision Blizzard: A strategic move to strengthen Microsoft's position in the gaming industry.

- Our Book Library's Acquisition of Whole Foods Market: A bold entry into the grocery retail sector.

- ExxonMobil's Merger with XTO Energy: A merger that created the world's largest oil and gas company at the time.

Corporate acquisitions and mergers represent powerful tools for driving business growth and reshaping industries. Navigating the complexities of these transactions requires a deep understanding of the legal, financial, and operational considerations involved. This comprehensive guide has provided a roadmap for business leaders, investors, and professionals to successfully execute corporate acquisitions and mergers in the United States. By embracing the strategies and best practices outlined in this article, organizations can maximize the potential of these transformative transactions and achieve long-term success.

4.8 out of 5

| Language | : | English |

| File size | : | 1060 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 259 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Bimal Ghosh

Bimal Ghosh Ed Morales

Ed Morales Wylie Sawyer

Wylie Sawyer Belinda Conniss

Belinda Conniss Blockhead

Blockhead Lynn Visson

Lynn Visson Bart Hendrickx

Bart Hendrickx Gary Chapman

Gary Chapman Laura Leist

Laura Leist Jeffrey Zaslow

Jeffrey Zaslow Barry Stroud

Barry Stroud Beau Breslin

Beau Breslin Ray Saulon

Ray Saulon Ryan Skinner

Ryan Skinner Black Stars Press

Black Stars Press Bernard L Schwartz

Bernard L Schwartz Fenella J Miller

Fenella J Miller Rebecca A Taylor

Rebecca A Taylor Becky Sue Epstein

Becky Sue Epstein George Sweanor

George Sweanor

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Julio CortázarUnveiling the Challenges and Rewards of Russian-American Marriages: A Review...

Julio CortázarUnveiling the Challenges and Rewards of Russian-American Marriages: A Review... Bernard PowellFollow ·11.7k

Bernard PowellFollow ·11.7k Devin CoxFollow ·4.2k

Devin CoxFollow ·4.2k Marcus BellFollow ·4.3k

Marcus BellFollow ·4.3k Ken FollettFollow ·14.2k

Ken FollettFollow ·14.2k Israel BellFollow ·9.4k

Israel BellFollow ·9.4k Dean ButlerFollow ·14.7k

Dean ButlerFollow ·14.7k W. Somerset MaughamFollow ·10.8k

W. Somerset MaughamFollow ·10.8k Amir SimmonsFollow ·10.8k

Amir SimmonsFollow ·10.8k

Edison Mitchell

Edison MitchellFrench Strategy and Operations in the Great War

An In-Depth Examination of Military Genius ...

Harvey Hughes

Harvey HughesArts In Health: Designing And Researching Interventions

Delving into the...

Walt Whitman

Walt WhitmanHealing and Hope for Those with Empty Arms

A Comprehensive Guide for Grieving...

DeShawn Powell

DeShawn PowellUniversity of Maine Ice Hockey: A Legacy of Frozen Glory

Nestled in the heart of Maine, a state...

George Hayes

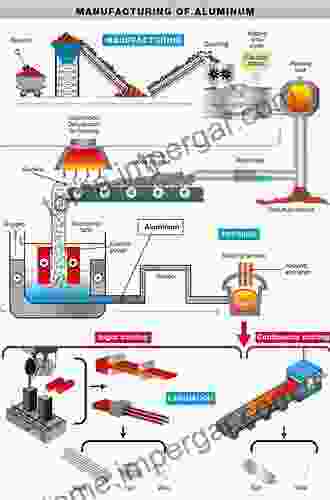

George HayesControl For Aluminum Production And Other Processing...

In today's competitive manufacturing...

Ben Hayes

Ben HayesThe Lost Obelisks Of Egypt: A Journey into the Depths of...

: The Enduring Allure of Egypt's Ancient...

4.8 out of 5

| Language | : | English |

| File size | : | 1060 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 259 pages |